Removing Guesswork From Property Investing with PrimeKey Analysis

Investing in property is often seen as one of the most significant financial milestones in a person’s life. Yet, for many, the process is shrouded in uncertainty. Is this the right time to buy? Is this specific project a goldmine or a potential trap? Are we following sound data, or just the latest market hype?

In real estate, the thin line between a high-performing investment and a costly mistake is rarely a matter of luck. It is a matter of clarity.

Moving Beyond "Guesstimation"

For years, many investors have relied on "gut feelings" or the advice of well-meaning friends. While intuition has its place, the modern Singapore property landscape is far too complex for guesswork. With cooling measures, fluctuating interest rates, and a rapidly evolving URA Masterplan, the margin for error has narrowed.

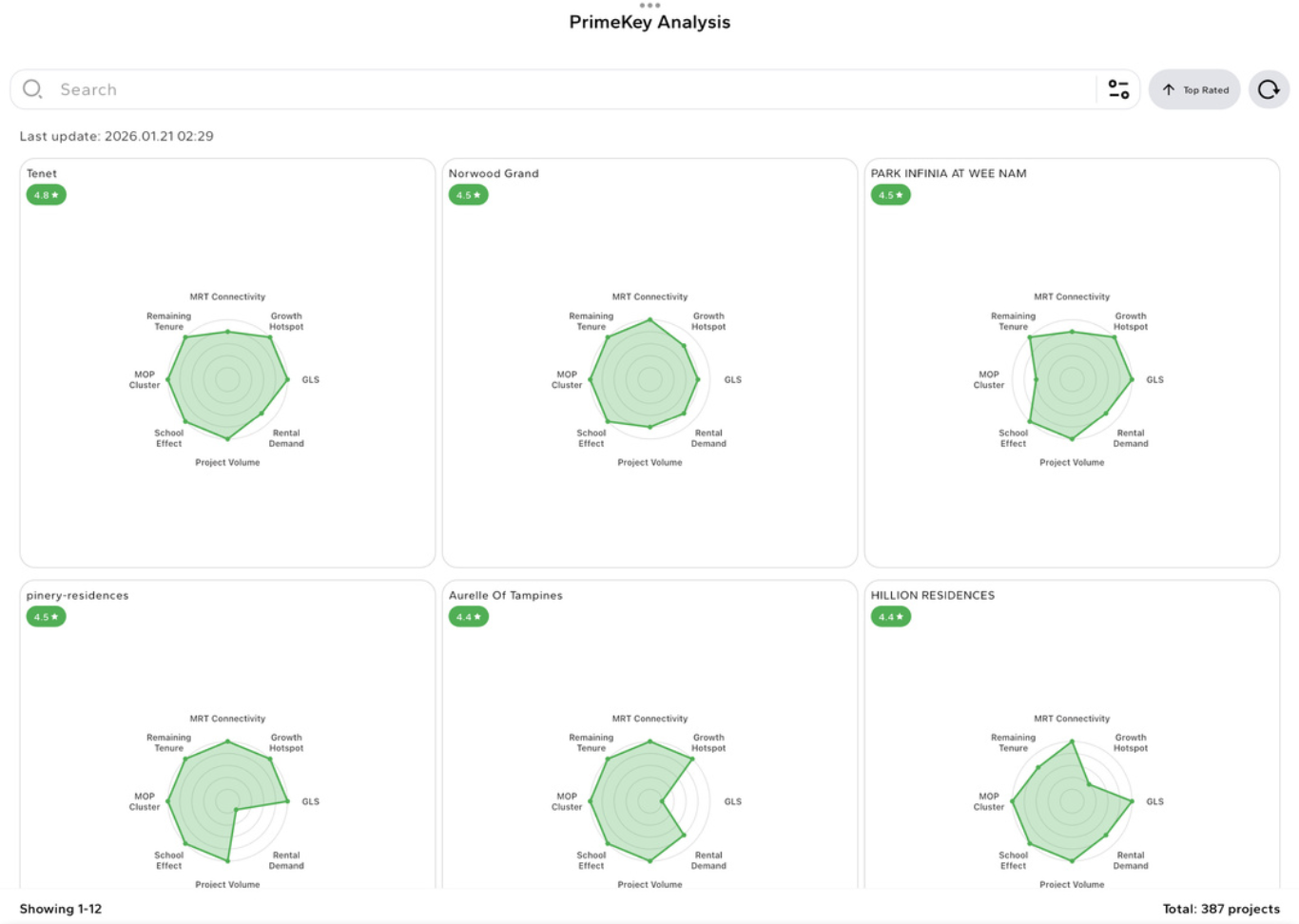

This is where PrimeKey Analysis comes in.

PrimeKey isn’t just a tool; it’s a systematic framework designed to strip away the noise and focus on the fundamental pillars of a successful property acquisition. By shifting from a "hope-and-see" approach to a "data-driven" strategy, investors can move forward with absolute conviction.

The Pillars of PrimeKey Analysis

At its core, PrimeKey Analysis focuses on four critical dimensions to evaluate any potential property:

The Quantitative Anchor: We look past the glossy brochures to analyze historical transaction velocity and price trends. By normalizing PSF against surrounding comparable projects, we determine if you are entering at a "fair" or "undervalued" price point.

Distribution of Risk: We don’t just look for profit; we look for safety. This involves assessing the "Probabilistic Success" of a project. Does it meet the criteria for capital appreciation and rental yield strength? Meeting three out of four key indicators significantly tilts the odds of long-term success in your favor.

The Catalyst Check: Every great investment has a growth story. Using the URA Masterplan as a roadmap, PrimeKey identifies infrastructure developments and future transformations that act as a "tide" to lift property values in specific districts.

Financial Fortification: Clarity starts with your own numbers. PrimeKey integrates meticulous financial planning—assessing loan eligibility, tax efficiency through manner of holding, and ensuring a healthy cash buffer to weather any market cycles.

Clarity is the Ultimate Competitive Advantage

The goal of PrimeKey Analysis is simple: to give you the same level of insight that institutional investors use. When you remove the guesswork, you remove the stress. You no longer wonder if you made the right choice because the data has already told you.

Whether you are a first-time buyer looking for a home that doubles as an investment, or a seasoned investor looking to restructure your portfolio for better yield, having a proven framework makes all the difference.

Stop guessing and start planning. If you are ready to gain clarity on your next property move and want to see how PrimeKey Analysis can be applied to your specific situation, reach out today.

Here is an EXAMPLE of the PrimeKey Analaysis Report. CLICK HERE to view the FULL report

To find out more and take the first step toward a clearer investment future, contact Edmund Lim.