$4,000 PSF: The New "Normal" We Are Sleepwalking Into?

If I told you today that a standard condo in the city fringe would cost $4,000 psf in the future, you might call it impossible.

But pause for a moment. Remember when $1,000 psf was the psychological ceiling for the suburbs? Today, mass-market launches are breaching $2,300 psf without blinking. The shock of today becomes the bargain of tomorrow.

According to deep-dive projections from major financial institutions like DBS, Singapore’s property market is on a trajectory to see prices appreciate by another 35% to 55% by 2040.1 This puts prime and city-fringe assets on a direct collision course with the $4,000 psf mark.

Here is the math behind the madness—and the charts that prove why this demand is inevitable.

1. The Trillion-Dollar Anchor

Price growth requires fuel, and that fuel is economic expansion. By 2040, Singapore’s economy is projected to more than double, reaching a staggering USD 1.2 trillion to USD 1.4 trillion.

Data Source: DBS Asian Insights, IMF 3

This isn't just a GDP statistic; it flows down to your wallet. Median household incomes are projected to rise from today's levels to potentially $16,000 - $18,000 per month by the late 2030s.3

The Reality Check: A $4,000 psf property sounds expensive today. But to a household earning $18,000 a month in 2040, it will look exactly like a $2,200 psf property looks to us today—expensive, yes, but attainable for the upper-middle class.

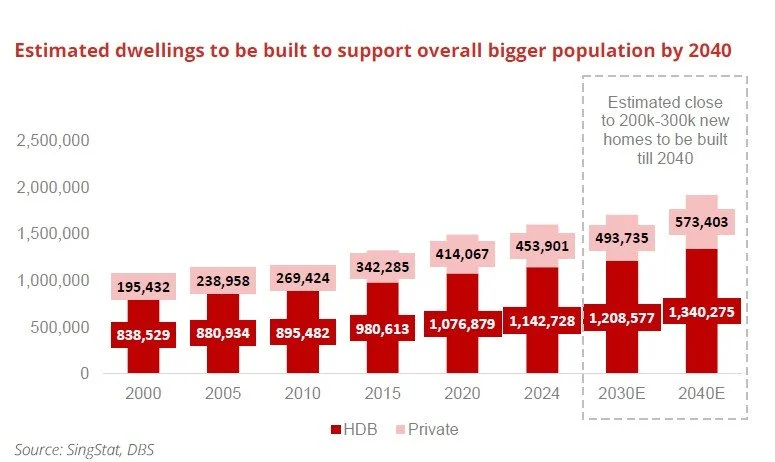

2. The "Divisor Effect": Why 6.9 Million People Need More Homes Than You Think

The headline number everyone watches is the population target of roughly 6.5 to 6.9 million by 2040.4 But looking at the total population count misses the real story. The explosive demand isn't coming just from more people; it is coming from smaller families.

We are witnessing a structural shift in how we live:

Shrinking Household Sizes: As the average household size dips below 3.0 persons (due to more singles and nuclear families), the same population requires significantly more housing units.3

The Silver "Rightsizing" Wave: Instead of selling off and moving in with children, the wealthy elderly of 2040 will choose to live independently in "right-sized" units. This keeps inventory off the market while creating new demand for 2-bedroom and amenity-rich homes.

This "divisor effect" creates a structural deficit. Estimates suggest we need to build 320,000 new homes just to keep up with this household formation rate.

3. Scarcity is the Multiplier

While we are building new precincts, land remains the one resource Singapore cannot print. The map of Singapore is being redrawn to create value in specific, decentralized nodes.

As the Singapore Dollar potentially moves toward parity with the US Dollar 7, Singapore real estate cements its status not just as a home, but as a global store of value—a "Swiss vault" in Asia.

Don't Be Left Holding a 2025 Map

The market is bifurcating. The tide will not lift all boats equally.

The path to $4,000 psf will be paved with specific opportunities—likely in the Rest of Central Region (RCR) hubs and the new "decentralized CBDs" like Jurong Lake District which are poised to close the gap with the traditional prime districts.1

Are you positioned in the precincts that will lead this charge, or are you holding assets likely to stagnate?

I have broken down the 2040 forecast into a precinct-by-precinct roadmap. If you want to future-proof your portfolio against the next 15 years of change, let’s have a coffee.

You can download the DBS 2040 report HERE.

Disclaimer: All information is provided "as is", with no guarantee of completeness, and accuracy. In no event will I thereof be liable in contract or in tort, to any party for any decision made or action taken in reliance on the information in this presentation/document or for any direct, indirect, consequential, special or similar damages